Definition of “Local”: Survey Findings

In response to the CFIA’s consultation on the modernization of labelling process, Sustain Ontario prepared a letter to reflect

our alliance’s perspectives on labelling and food. We’ve posted it here for you to read and give feedback on. The response was based on a survey conducted during August and September of 2013. The survey was completed by 281 Ontarian respondents, self-identifying their businesses and organizations within sectors such as farming (23.24%), health and nutrition (15.68%), food literacy and education (15.14%), food security (11.89%), food policy (10.27) and retail and food service (8.11%), among others. This wide range of provincial stakeholders also represent a variety of geographies, providing perspectives from both larger cities such as Toronto, Ottawa, London and Thunder Bay, as well as smaller communities such as Belleville, Bancroft, and Norfolk County. See the map for a snapshot of where survey respondents are located.

A complete report on the survey findings is currently being prepared and will be made available on this page.

See the original consultation survey.

Backgrounder on the Canadian Food Inspection Agency’s Food Labelling Modernization Process.

The following is a preview of the surveys findings.

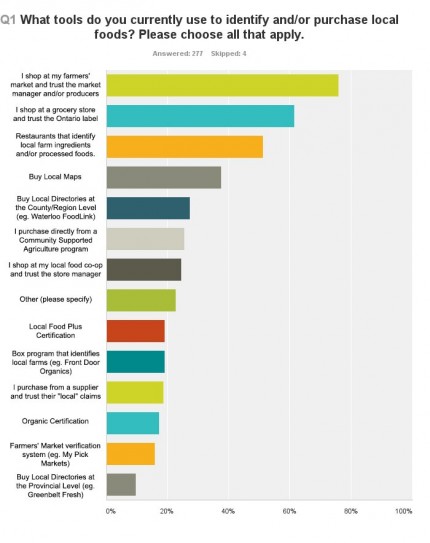

Respondents were asked, “what tools do you currently use to identify and/or purchase local foods? “. The most popular response to this question was, “I shop at my famers’ market and trust the market manager and/or producer.” Within the options given, there was an “other” category to respond to. Throughout the written responses, the most common theme was, the respondents having actual contact with farmers and/or producers, by purchasing directly from farms, or farm stands, as well as growing their own food. Therefore, it is extremely important to continue face-to-face interactions.

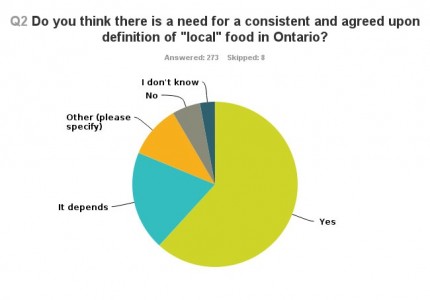

For question two of the survey, respondents were asked “do you think there is a need for a consistent and agreed upon definition of “local” food in Ontario?”. The most common response, was “Yes, there is a need for a consistent and agreed upon definition of “local” food in Ontario”, approximately , 61.54% of respondents answered this way.

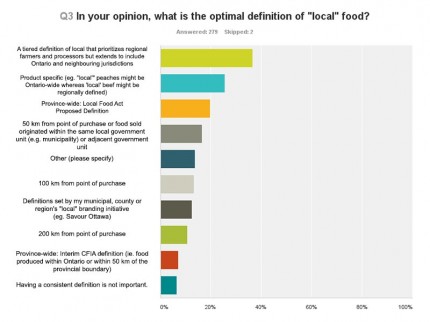

The following question was asked during the survey “in your opinion, what is the optimal definition of ‘local’ food”?. The top answer, with 36.56% of respondents choosing it was, “a tired definition of local that prioritizes regional farmers and processors but extends to include Ontario and neighboring jurisdictions (e.g. a points-based system). The second most popular answer, with approximately 25.45% of respondents choosing it was “product specific (e.g. local peaches might be Ontario-wide, whereas ‘local’ beef might be regionally defined).

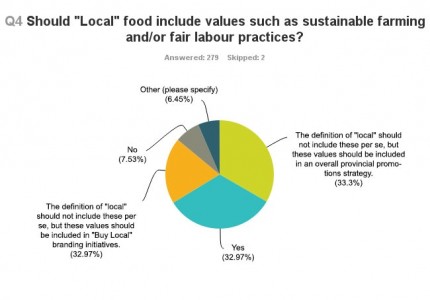

Question number 4 of the survey, asked respondents “should ‘local’ food include values such as sustainable farming and/or fair labour practices?”. The top three responses for this question, were really close and have a similar context. Approximately 33.33% of respondents answered that “the definition of ‘local’ should not include these per se, but these values should be included in an overall provincial promotions strategy.” Furthermore, 32.97% of the respondents agree that “yes, ‘local’ food should include values such as sustainable farming and/or fair labour practices”. However, on the other hand, 32.97% of respondents states that “the definition of ‘local’ should not include these per se, but these values should be included in ‘Buy Local’ branding initiatives”. With 7.53% stating “no, ‘local’ food should not include values such as sustainable farming and/or fair labour practices and 6.45% of respondents selecting “other” and specifying that words such as “sustainable” are terms that cannot be included in a definition, as they are too hard to define on their own.

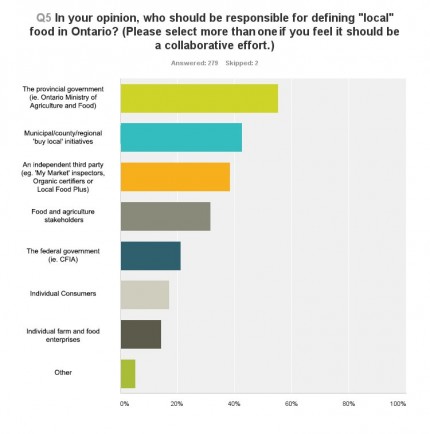

Question number 5 of the survey was, “in your opinion, who should be responsible for defining ‘local’ food in Ontario? (please select more than one if you feel it should be a collaborative effort”. The top three responses were as follows, “the provincial government should be responsible (i.e. Ontario Ministry of Agriculture and Food)” which 55.20% responding this way. The second most popular responses, with 42.65% of respondents choosing it was “Municipal/county/regional ‘buy local’ initiatives and finally “an independent third party (e.g. “My Market inspectors, organic certifiers or Local Food Plus) with 38.35% selecting this response.

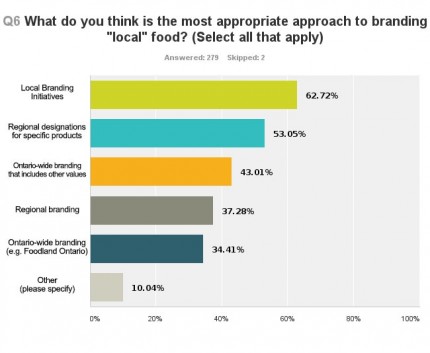

Respondents were asked “what do you think is the most appropriate approach to branding ‘local’ food?”. The most popular answer selected was “local branding initiatives”, which was chosen by 62.72% of the respondents. Furthermore, approximately 53.05% of respondents selected “regional designations for specific products”. With the option to select “other” and respondents having the choice to explain how they feel, the most common theme was about honesty and integrity being the most important to the respondents.

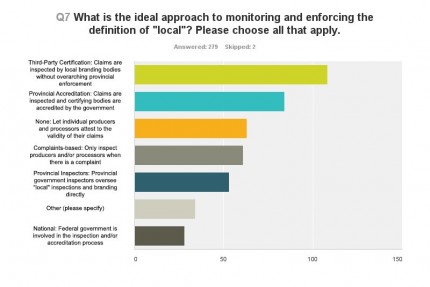

Question # 7 asked respondents, “what is the ideal approach to monitoring and enforcing the definition of ‘local'”. The top response chosen by 38.71% was, “third-party certification: claims are inspected by local branding bodies without overarching provincial enforcement.” Whereas, 30.11% selected “provincial accreditation: claims are inspects and certifying bodies are accredited by the government”.

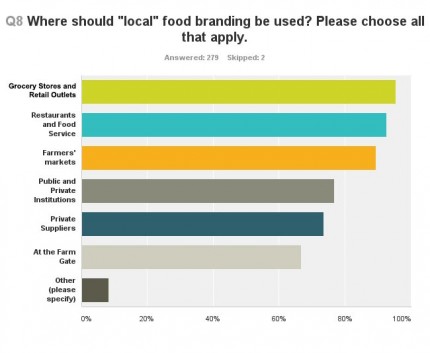

The following question was asked of respondents, “where should ‘local’ food branding be used?”. There were three top responses that were very close in numbers, these were; “grocery stores and retail outlets” which was selected by 95.35%, “restaurants and food service” was the second most popular choice, which was selected by 92.47% of respondents and finally 89.25% of respondents selected “farmers’ markets” as where “local” food branding should be used.

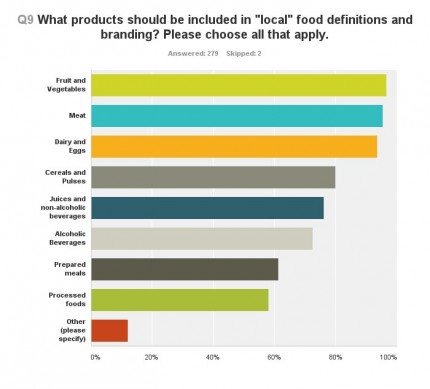

Question #9 asked respondents, “what products should be included in ‘local’ food definitions and branding”. For this question there were three answers that were selected by 90% or more respondents. The top answer selected was “fruit and vegetables”, which was chosen by 96.42%, “meat” was selected by 95.34% of respondents and lastly, “dairy and eggs” was selected by 93.55% of respondents.