Food Producers Can Donate Food, Get Tax Credit

Posted: August 10, 2016

Categories: GoodFoodBites / News from Sustain Ontario

Hand-Picked Ontario Beans

The Province wants to help bring more local food to communities across Ontario. A provision of the Local Food Act (Bill 36) grants farmers a tax credit valued at 25 per cent of the fair market value of the agricultural products they donate to eligible community food programs. According to OMAFRA, items may include fruits, vegetables, meat, eggs or dairy products, fish, grains, pulses, herbs, honey, maple syrup, mushrooms, nuts, or anything else that is grown, raised or harvested on a farm and that in Ontario legally can be sold at a place other than the premises of its producer.

Full details about eligibility and how to access the tax credit are available from OMAFRA or visit the Ontario Ministry of Finance FAQs for the program.

More benefits of tax credit

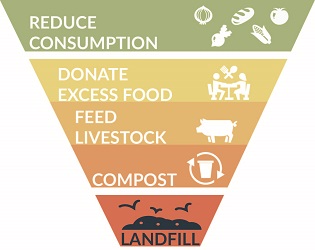

The benefits of donating food reach beyond the tax credit. With an estimated 1 in 8 Canadian families struggling to put food on the table and a growing demand on food banks, the provincial tax incentive helps Ontario’s food producers contribute much needed, healthy food to food centres facing growing demands. It also allows farmers to participate in important food recovery and to combat food waste that costs Canadians an estimated $31 billion each year.

Sustain Ontario’s Reducing Household Food Waste: A Municipal-Regional Toolkit provides further actions to accelerate food waste reduction and diversion that contribute to healthier food systems in Ontario.